In September 2023, we launched Veeqo Credits to assist sellers in saving on shipping costs. I led in various capacities, including product strategy, research, and design. I collaborated with leaders and colleagues from Veeqo and Amazon to successfully launch the Veeqo Credits program at Accelerate 2023.

Veeqo Credits is now Amazon's leading seller acquisition program. It set a new standard for increasing shipment volume, seller activation, and retention while saving sellers thousands of dollars annually on shipping costs.

- - Lead Product Designer

- - Product Manager

The Challenge

The Challenge

What difference did we make?

0%

0%

Preview

Some context

A little bit about Veeqo

Veeqo is an order fulfillment platform for e-commerce businesses operating across multiple sales channels in the UK. Its primary focus is streamlining and optimizing the order fulfillment operation while providing integrations for all major shipping carriers.

Veeqo is a free-to-use product that generates revenue by collecting a small percentage fee per shipping label purchased to fulfill an order.

Veeqo was acquired by Amazon in late 2021 and launched in the US in 2022.

Following the acquisition, we dedicated the subsequent year to integrating Amazon Buy Shipping as Veeqo's backend for shipping. The aim was to enable sellers to access Amazon Shipping rates immediately without negotiating individual carrier accounts—a process that previously took weeks to months and slowed down a seller's business with each negotiation. Additionally, Amazon Buy Shipping allowed sellers to qualify automatically for Prime Shipping, offering a significant incentive for sellers to succeed on Amazon Marketplaces.

The Investigation

Just enough research

After launching in the US, the Veeqo team monitored the launch performance. We soon realized that while our sign-up metrics were increasing, there was a high abandonment rate after US sellers completed the initial setup.

To understand the high abandonment rate, I quickly implemented an exploratory research approach to uncover why Veeqo was not meeting the needs of US sellers.

Session Tracking

I analyzed Fullstory sessions of new seller sign-ups to find abandonment and friction points during the US onboarding journey.

Surveys

I created and ran a post-signup abandonment survey to explore the issues observed in Fullstory.

Seller Calls

I organized calls with sellers to gain deeper insights into their needs, which proved crucial in defining our understanding of their issues.

Engaging with sellers on Amazon's Seller Forums and Reddit was an effective way to connect with passionate sellers. I could schedule video calls and distribute surveys to a highly engaged community by seeking seller feedback from these channels. These sellers were enthusiastic about their businesses and eager to offer feedback. Some of these sellers even became beta testers!

Major learnings

After my initial observations and collection of the survey results, several themes regarding shipping emerged.

Veeqo was a better fit for larger sellers

Larger sellers (weekly orders in the thousands) were the most interested in using Veeqo, not the smaller sellers initially targeted in the US launch. They were interested in the bulk shipping automation features that Veeqo provided.

Rate shopping

Sellers were signing up to compare their shipping rates to Veeqo's. All other features were secondary.

Uncompetitive rates

Veeqo shipping rates were often less competitive than the sellers' negotiated rates.

Rate sensitivity

Even a cent or two added to shipping rates drove sellers away. These small amounts significantly impacted their shipping expenses based on the chosen carrier and shipping volume.

Competitive pricing was not enough–the baseline requirement was the best shipping rates for sellers to use Veeqo.

In our attempt to integrate with Amazon, we aimed to give sellers access to more shipping carriers than they can typically access. However, we wrongly assumed that the shipping rates provided by Buy Shipping were the best, which was not the case.

Refocus on the seller

Cross-functional discussions & brainstorming

Once I shared my findings with the product team, I quickly assembled a cross-disciplinary group focused on making Veeqo the most cost-effective choice for sellers. The team consisted of finance, product marketing, legal, and engineering team members.

For confidentiality reasons, I have lightly outlined the artifacts that defined the product strategy and direction below.

We started discussions & brainstorming sessions. As a standard practice, we used the working backwards principle to ensure that the optimal seller experience was always our top priority as we addressed the business problem and understood our constraints.

As the constraints of the challenge became more evident, I began exploring various concepts and presented them as potential solutions during our discussions. I also shared these concepts with Amazon leaders to guide conversations and provide direction for the strategy.

Explored options

The decision map provided was a general outline of the options explored and discussed to identify the best direction while identifying trade-offs, risks, and constraints. This process was an iterative back-and-forth with our team and Amazon leaders to obtain final approval.

A major constraint

After exploring various options, we secured final approval and funding from Amazon leadership, centered around one key constraint.

Confidential information with carriers prevented Veeqo from offering direct discounts on shipping rates. Veeqo had to sell shipping labels at the rates provided by the shipping carriers at the time of the transaction.

Instead of viewing this as a limitation, I saw it as an opportunity for a new growth strategy.

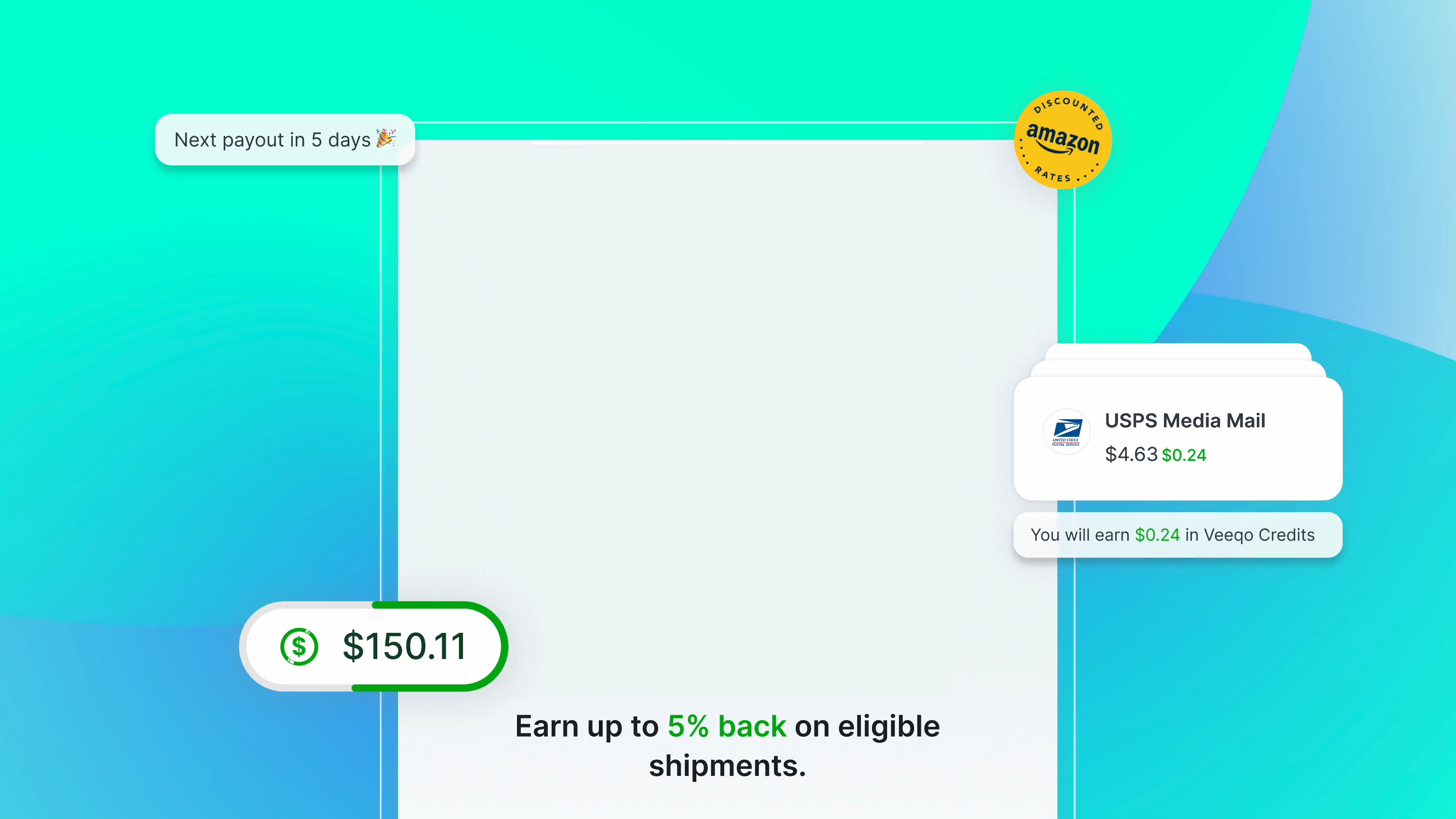

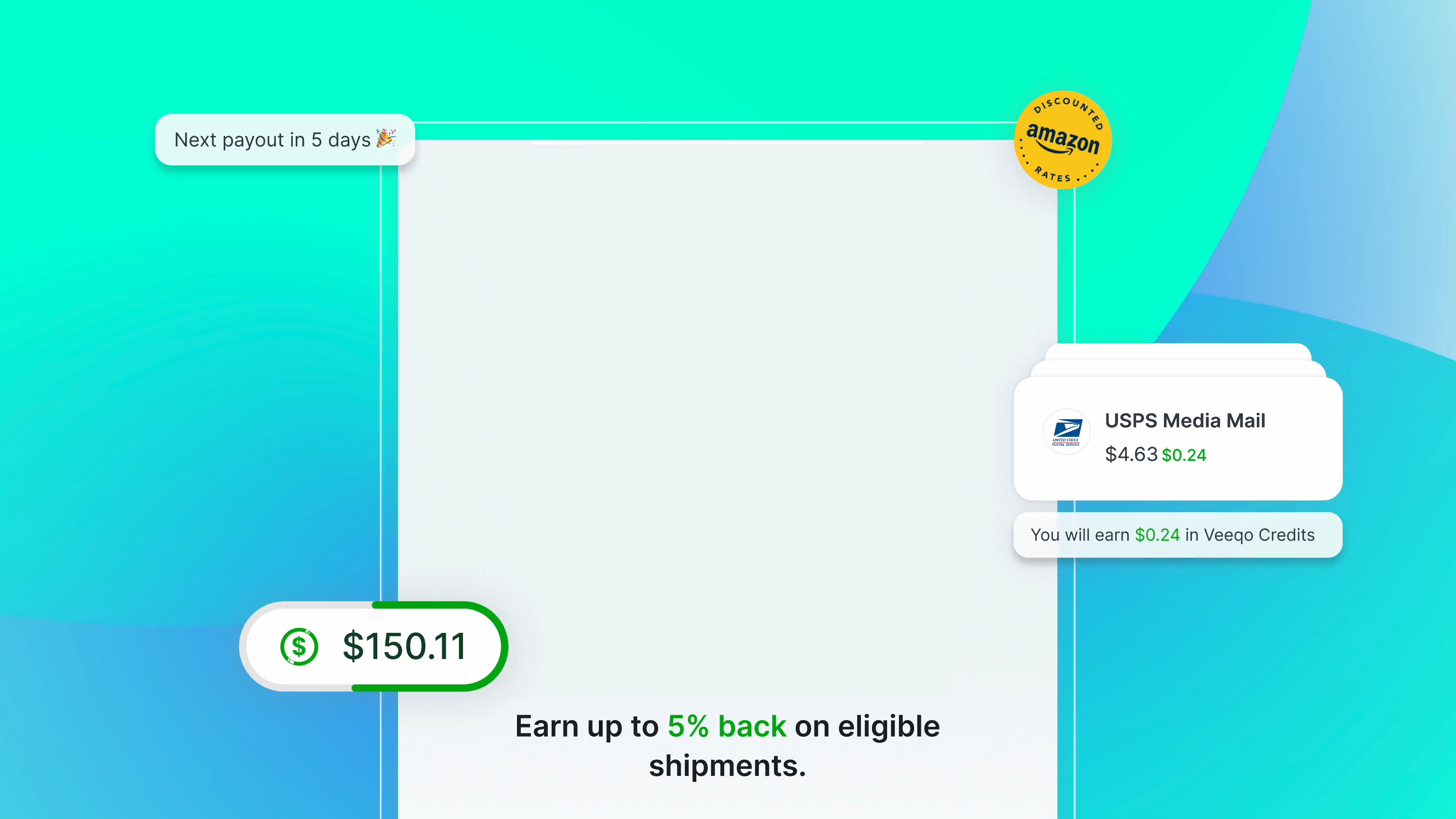

Earlier in the brainstorming sessions, I suggested a credit-based program with several advantages. This program could boost customer retention, provide a continuous product marketing and acquisition channel for Veeqo, and allow for deferred payments, directly addressing the new constraint. This concept became the cornerstone of the solution and one of the key reasons we gained final approval.

The Hypothesis

Finding direction

Asking the right questions

I created a set of questions to establish a common foundation that the team consistently referred back to as we delved deeper into the project. We used these questions to ensure internal alignment and to unearth any underlying assumptions.

The following questions have been generalized from Amazon's PR/FAQ to outline and guide product development and strategic direction.

- How does the Veeqo Credits program align with Amazon's e-commerce seller ecosystem strategy?

- What is the projected return on investment (ROI) for the credits program over the next 3-5 years?

- How do the credits impact Veeqo's unit economics and overall business model?

- What competitive advantages does this program create in the shipping platform market?

- How does the program support Veeqo's long-term monetization strategy?

- What financial modeling supports the sustainability of the credits approach?

- How does this program differentiate Veeqo from other shipping and order fulfillment platforms?

- What specific pain points does the Veeqo Credits program directly address for sellers?

- How do different seller segments (small, medium, large) perceive the value of the credits?

- What mental models do sellers use when evaluating shipping cost savings?

- How does the credits program change sellers' perception of Veeqo as a platform?

- What emotional and rational triggers make the credits compelling to sellers?

- How do sellers compare the Veeqo Credits value proposition to alternative shipping solutions?

- What additional value can we communicate beyond the direct financial benefit?

- What are the precise rules and limitations of credit earning and redemption?

- How did we determine the optimal credit rate (up to 5%)?

- What carrier and shipping service criteria determine credit eligibility?

- How frequently are credits calculated and distributed?

- What mechanisms prevent potential abuse of the credits system?

- How transparent are the credit calculations to sellers?

- What happens to credits in edge cases like label cancellations or returns?

- What backend infrastructure was required to support the credits system?

- How did we integrate the credits mechanism with existing shipping label purchase flows?

- What performance considerations were critical in implementing real-time credit calculations?

- How did we ensure accurate tracking and attribution of credits?

- What database and caching strategies were employed?

- How scalable is the current technical implementation?

- What load testing was conducted to validate the system's robustness?

- How does the credits program serve as a customer acquisition tool?

- What conversion rate improvements have we observed during onboarding?

- How does the program influence seller activation and first-time label purchases?

- What referral or viral mechanisms can we build into the credits program?

- How do credits compare to other seller acquisition strategies in terms of cost-effectiveness?

- What marketing channels are most effective in communicating the credits value?

- How can we leverage the credits program to expand into new market segments?

- What key performance indicators (KPIs) are used to measure the credits program's success?

- How do we track and attribute the impact of credits on seller retention?

- What dashboards and reporting tools have been developed for internal and seller-facing analytics?

- How granular are our credit usage and impact measurements?

- What predictive analytics can we develop around credit behavior?

- How do we correlate credits with other business metrics like total shipment volume?

- What insights can we derive from seller credit utilization patterns?

- What potential fraud vectors exist in the credits system?

- How do we handle scenarios like account closures or transfers?

- What financial risks are associated with the credits program?

- How robust are our systems in handling unexpected high-volume credit scenarios?

- What compliance and legal considerations must we continuously monitor?

- How do we manage credits during carrier rate fluctuations?

- What contingency plans exist if the program doesn't meet expected performance metrics?

- How can we personalize the credits experience for different seller segments?

- What additional features could enhance the credits program?

- How might we expand credits to other services beyond shipping?

- What machine learning or AI capabilities could we integrate?

- How can credits become more predictive and proactive for sellers?

- What international expansion considerations exist?

- How might we create more dynamic and flexible credit structures?

Defining success

It was also essential to establish a clear definition of success that the entire team, including Amazon leaders, could agree on. This definition would serve as a reference point in discussions, for making improvements, and for evaluating the impact after the launch.

Increase US seller retention

Increase US seller retention by 20%.

Increase US shipping volume

Increase US shipping volume by 10%-15%.

The best US shipping rates

Offer the best US shipping rates in the shipping space.

Explore

My design process

My design process consists of two major phases: an exploration phase to generate a wide range of ideas and a narrowing down phase to iterate on the most effective concepts with deeper refinement.

Wide exploration

I typically use this phase to identify the right mental model for engaging with sellers, so I created various treatments to showcase discounts and credits earned.

I started by finding the best and most logical location for communicating with sellers that Veeqo offers the best shipping rates for US sellers besides each label.

I then began iterating on different credit and discount concepts and visual treatments. Some concepts seemed promising, while others were there to challenge my assumptions. I built prototypes to test these assumptions and collect feedback from sellers on UserTesting.com and directly over video calls.